HOW TO USE THE ACCOUNTANT COPY IN INTUIT QUICKBOOKS DESKTOP

Using the Accountant's Copy

Intuit Quickbooks support TOLL-FREE # 1800-875-9516

Learn how to use the Accountant's Copy in QuickBooks Desktop.

The Accountant's Copy feature in QuickBooks Desktop lets accountants and clients to work on a company file at the same time. The Accountant's Copy is seamlessly transferred between accountants and clients without the need to email bulky files.

The following sections outline how an Accountant's Copy works. It also explains what you can and can't do in the Accountant's Copy.

Accountant's Copy: Workflow

Rather than saving the Accountant’s Copy file on your computer or thumb drive, the Accountant's Copy feature transfers files between accountants and clients through Intuit servers.

The following process illustrates the Accountant's Copy feature workflow:

- The client creates an Accountant's Copy to send to the accountant for review and editing. The client can continue to work on current items in the working file (.QBW).

- QuickBooks Desktop saves the Accountant’s Copy as an export file (.QBX) to the Intuit server.

- This triggers the system to send an email with a download link for the export file to the accountant.

- The accountant accesses and opens the file, creating a working file (.QBA), and makes changes and corrections in it.

- The accountant saves their changes and corrections, creating an import file (.QBY), which is saved to the Intuit server.

- The client can then open this import file to apply the accountant's changes to the company file.

Dividing date: Explained

The Accountant's Copy uses the Dividing Date to define the fiscal period the accountant can work on. The Dividing Date restricts the transactions the accountant can modify.

Accountants can only modify transactions that fall on or before the dividing date. To prevent conflict or the possibility of overwriting changes, clients can only modify transactions in their working file that fall after the dividing date unless the Accountant’s Copy Restriction is removed.

Clients: What you can (and can't) do while changes are pending

While your accountant is making changes in the Accountant's Copy you sent, you can work in the .QBW working file to make changes to transactions in the current period, after the dividing date.

You can also make the following types of changes in the QBW file with pending accountant’s changes:

- Add new entries to any of your lists

- Create, edit, and delete transactions

- Edit the list information

- Turn on Payroll

However, while accountant's changes are pending, you can't make the following changes:

- Edit or delete existing accounts

- Send Assisted Payroll Data or Direct Deposits to Intuit

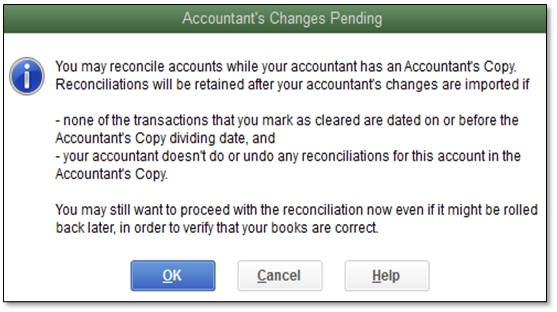

Clients: Reconciliation and pending changes

It's possible to reconcile your accounts with a pending Accountant's Copy. However, your reconciliation may be rolled back if you clear transactions dated on or before the dividing date, or if your accountant reconciles the Accountant's Copy and undoes your reconciliation.

Verify with your accountant whether they plan to reconcile the Accountant’s Copy before you reconcile your accounts in your working file.

Reconciliations performed in an Accountant's Copy are limited to 800 transactions. If the number of transactions reconciled is more than 800, then the reconciliation won't import into the client file.

Accountants: What you can (and can't) do in an Accountant's copy

When you receive an Accountant's Copy from your client, QuickBooks Desktop prevents you from editing information or transactions that may conflict with your client's work. It also prevents your client from editing the information before the Dividing Date to avoid conflict with any changes you make.

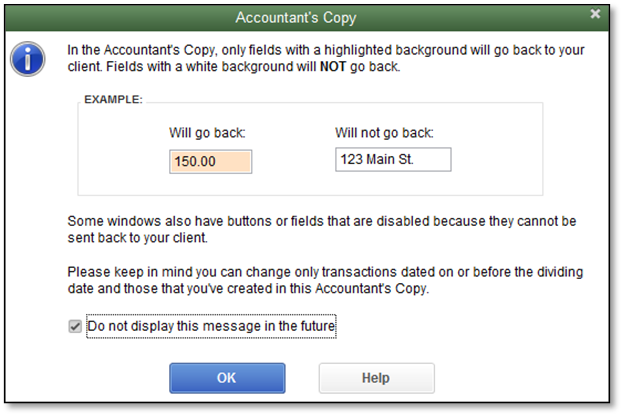

When working in an Accountant's Copy (the .QBA working file), you may encounter disabled or sometimes highlighted areas in a client's file:

- Highlighted background: Information entered in these fields is included in the change file that you send back to your client

- Non-highlighted background: You can change information in non-highlighted fields, if necessary, but the changes are not included in the change file you send back to your client

There are also some specific limitations of the type of changes you can make.

The following sections provide details about the specific changes you can and cannot make in an Accountant's Copy.

Lists: What you can (and can't) do

When working with Lists, you can make the following changes in an Accountant's Copy:

- Add an item to the Class List, Customer List, Employee List, Fixed Asset Item, Item List, Other Names List, Vendor List, and Sales Tax Code List (Exception: You can't edit or make items on the Sales Tax Code List inactive)

- Edit items on the Vendor List and the Item List (Exception: You can't change an item to another type on the Item List)

You cannot make the following changes:

- Add, edit, void, or delete build assemblies

- Change the type of an item

- Delete and merge existing accounts

- Enter vehicle mileage

Transactions: What you can (and can't) do

When working on transactions, you can make the following changes in an Accountant's Copy:

- Add, edit, and delete most types of transactions dated on or before the dividing date

- Add new transactions dated after the dividing date

- Edit account and tax information for existing items (tax line mapping cannot be sent back to the client)

- Temporarily change preferences

- Make adjusting entries

You cannot make the following changes:

- Add, delete, and edit (but not void) payments received

- Add, edit, void, or delete sales tax payments

- Add or use credit card processing

- Create non-posting transactions such as estimates and sales orders

- Edit or void bill payments by credit card

- Transfer funds between accounts

Payroll: What you can (and can't) do

When working on payroll-related items, you are generally restricted from making changes in the Accountant's Copy. Although you can still process payroll tax forms. (For more information, see Processing payroll or payroll forms in an Accountant's Copy)

You can't make the following payroll-related changes in an Accountant's Copy:

- Add, edit, or delete payroll items

- Create, edit, delete, or void paychecks

- Enter, edit, or delete time sheet data

- Create, edit, delete, or void Direct Deposit checks for 1099 vendors

- Send Assisted Payroll Data or Direct Deposits to Intuit

What else you can (and can't) do

When working in an Accountant's Copy, you can make the following changes:

- Print 1099 and 1096 forms in the historical period

- Create, adjust, and print 941, 940, and W-2 forms(You can't send adjustments back to the client)

- Create new reports

- Add new customers, vendors, employees, and items(Exceptions are identified as disabled fields in the Accountant's Copy)

You cannot make the following changes in an Accountant's Copy:

- Import data from Excel, Web Connect, and QuickBooks timer files

- Manage service keys (buy additional licenses)

- Use planning and budgeting tools

- Use online banking services

Additionally, you cannot send the following changes back to the client:

- User or password changes

- Changes to memorized reports

- Changes to preferences

Product versions: Accountant's Copy and QuickBooks Desktop

Ideally, the client and accountant using the Accountant's Copy feature should use the same version or year of QuickBooks Desktop.

However, you can still work on the Accountant’s Copy using a different version as long as the gap between the versions is just one year, and the accountant has the more recent version.

For example:

- Client: QuickBooks Desktop Pro or Premier 2018Accountant: QuickBooks Desktop Premier Accountant Edition 2018

- Client: QuickBooks Desktop Pro or Premier 2017Accountant: QuickBooks Desktop Premier Accountant Edition 2017 or 2018

- Client: QuickBooks Desktop Enterprise 2018Accountant: QuickBooks Desktop Enterprise Accountant Edition 2018

- Client: QuickBooks Desktop Enterprise 2017Accountant: QuickBooks Desktop Enterprise Accountant Edition 2017 or 2018

When you open an Accountant's Copy in a newer version of QuickBooks Desktop, the file needs to be upgraded. Any changes you make can be incorporated if they were made using a compatible version.

If an accountant makes changes using features that are not available in the client's version of QuickBooks Desktop, the changes are not imported to the client's file.

Reset the Accountant's Copy password

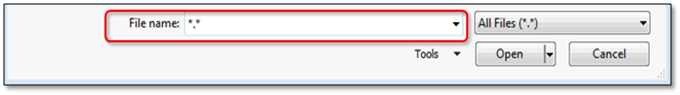

By default, the Automated Password Reset Tool displays working company files (with the file extension .QBW).

For the detailed steps to use the tool, see Automated Password Reset Tool

To reset the password for an Accountant's Copy (.QBA) file, after you select your version:

- Enter *.* in the File Name field to view all files in the selected directory.

- Select the Accountant's Copy (.QBA) file.

- Enter and confirm your New Password and select Reset Password to complete the process.

The Essential Accountant's Copy Guide

This article is part of a series about Accountant's Copy in QuickBooks. To learn more about this feature, check the following articles:

- Create an accountant's copy to send to your accountant

- Convert the accountant's copy to an accountant's working file

- Export accountant's changes

- Import accountant's changes

- Remove the accountant's copy restriction

- Convert an accountant's copy or an accountant's working file to a regular company file

THANK YOU FOR SUCH AN AWESOME FABOULOUS AND TECHNICAL INFORMATION ABOUT INTUIT QUICKBOOKS ACCOUNTANT DESKTOP YOU ARE FANTASTIC

ReplyDeleteSeveral times Binance users have to face issues unexpectedly due to issues in term of recognizing the verification by Binance. If you are also one of the clients among various and crossing through the same situation then immediately call our Binance support number to have a conversation with associated professionals. Binance Support Number The significant thing is that you will be required to be aware of picking the steps to talk to the customer care executives without any delay.

ReplyDeleteSeveral times Blockchain users have to face issues unexpectedly due to issues in term of recognizing the verification by Blockchain. If you are also one of the clients among various and crossing through the same situation then immediately call our Blockchain support number to have a conversation with associated professionals. Blockchain Support NUmber The significant thing is that you will be required to be aware of picking the steps to talk to the customer care executives without any delay.

ReplyDeleteRecently, the Gemini platform is facing trouble in to increase purchase limit. To remove this problem they must make a call on Gemini support number and convey the problem to the team experts. They will have insight to the issue and revert back to Gemini Support Number the user as soon as possible. The other way to connect is through Gemini service number. The services are available 24*7 for each user. They are always at your service, so you can reach them as per your comfort.

ReplyDeleteBlockchain also called Blockchain customer care United States the second largest as per the daily trading volume has its own sets of flaws which can only be treated under the assistance of skilled professionals. If Blockchain two-factor authentication is not working and you are looking Blockchain Customer Service Number for ways to handle all these errors, you can always contact the team of skilled professionals who are there to assist you in every possible manner. Call on Blockchain customer care number which is working and the team is ready to guide you through every possible manner.

ReplyDeleteDo you want to deposit money in the Binance exchange account? Binance exchange generally accept coins and cryptocurrencies but as per the latest news, it is going to launch 180 fiat currencies and now users can pay through visa and Mastercards. To know more about Binance features, Binance Customer Service Number you can always take help from the team of skilled professionals who are there to guide you. You can always call on Binance customer service number which is always functional and the team is ready to guide you at every step. This is the easiest route to get connected with the experts and get unlimited remedies from the roots.

ReplyDeleteBy outsourcing the services you provide to India, you can enjoy the advantage of saving up to 70% cost incurred on business operations. Data entry will be the hub of the business despite the fact that it may well appear to be simple to manage and handle, this requires many processes that should be dealt systematically bookkeeping data entry

ReplyDeleteBy outsourcing the services you provide to India, you can enjoy the advantage of saving up to 70% cost incurred on business operations. Data entry will be the hub of the business despite the fact that it may well appear to be simple to manage and handle, this requires many processes that should be dealt systematically bookkeeping data entry

ReplyDeleteDid you encounter issues while using payroll? Are you frustrated by those?? Don’t be!! To eliminate troubles that you are facing effortlessly, just ring us at our QuickBooks Payroll Support +1-855-533-6333 You don’t have to worry about anything as we are available 24/7 with our team of experts to help out users like you!!

ReplyDeleteQuickbooks Enterprise Support Phone Number +1-855-533-6333

Quickbooks Support Phone Number +1-855-533-6333

How to delete AOL account

ReplyDeleteAOL mail password reset

AOL Gold Sign In

Set up AOL Email

How do I make money from playing games and earning

ReplyDeleteThese are the https://casinowed.com/merit-casino/ three most popular forms of gambling, and are explained in a หาเงินออนไลน์ very microtouch solo titanium concise and concise manner. The most common herzamanindir.com/ forms of gambling kadangpintar are:

ReplyDeletewe sincerely appreciate the way you blogged.

softwarezguru.com

QuickBooks Enterprise Accountant Crack

How to Fix Quickbooks Error 12057

ReplyDelete